First Digital NextGen Mastercard – How To Apply

The First Digital NextGen Mastercard is designed for individuals looking to establish or rebuild their credit.

Anúncios

It offers accessibility even to those with poor or no credit history, making it a stepping stone toward better financial opportunities.

While it lacks traditional rewards, the card’s primary value lies in its acceptance, fast approval process, and credit-building potential. However, users should be mindful of its fees and interest rates.

First Digital NextGen Mastercard

Easy Approval Process High APRHow does the First Digital NextGen Mastercard work?

The First Digital NextGen Mastercard is straightforward and tailored for those who are new to credit or rebuilding it. Here’s how it works:

- Credit Approval: This card is designed for applicants with limited or poor credit, offering approval even without an excellent credit score.

- Reports to Major Credit Bureaus: The card helps build your credit history by reporting your payments to the three major credit bureaus—Experian, Equifax, and TransUnion.

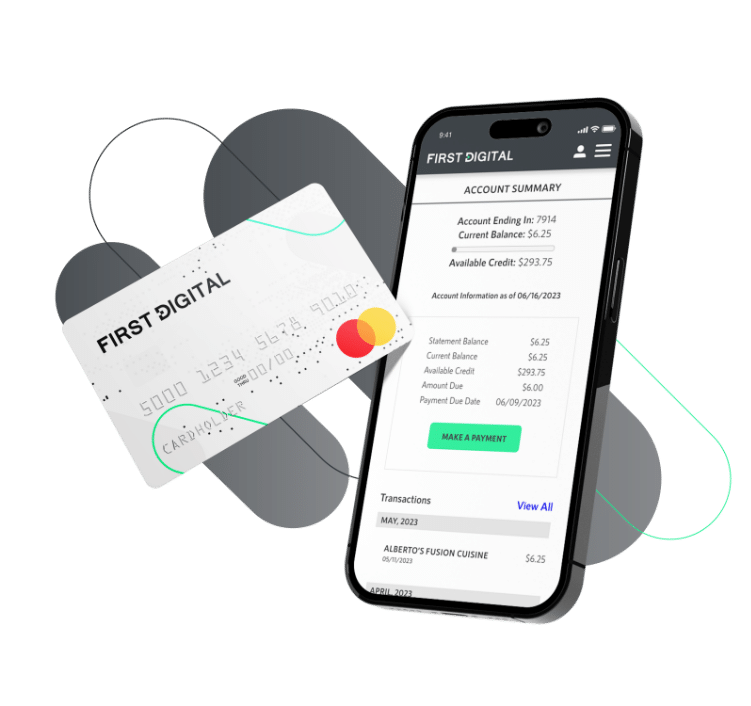

- Digital Management: You can manage your account online or via a mobile app, making it easy to track spending and payments.

- No Security Deposit Required: Unlike secured cards, this is an unsecured card, meaning no upfront deposit is needed.

- Initial Credit Limit: Cardholders receive a modest starting credit limit, which can increase over time with responsible use.

Main benefits of First Digital NextGen Mastercard

The First Digital NextGen Mastercard offers several features aimed at helping users improve their credit profile:

- Credit Building Opportunity: Regular reporting to major credit bureaus helps cardholders establish or rebuild their credit score with on-time payments.

- Wide Acceptance: As part of the Mastercard network, this card is accepted almost everywhere, both in-store and online.

- No Collateral Required: Unlike secured cards, there’s no need to provide a security deposit to open the account.

- Fast Approval Process: Applications are processed quickly, making it accessible for those who need credit without delay.

- Digital Account Management: The ability to manage your account online or through a mobile app adds convenience to your experience.

You will be redirected

Cons of First Digital NextGen Mastercard

While the card is accessible to those with limited credit options, there are significant drawbacks to consider:

- High Fees: The card comes with multiple fees, including an annual fee, monthly maintenance fee, and one-time program fee, which can add up.

- High APR: The card carries a high APR (up to 35.99%), making it costly if you carry a balance.

- Limited Credit Limit: The initial credit limit is typically low, which may not meet the needs of some users.

- No Rewards Program: Unlike many credit cards, this one doesn’t offer cashback, points, or other rewards.

- Not Ideal for Long-Term Use: Due to its high costs, this card is best used as a temporary tool for building credit.

APR and Fees

The First Digital NextGen Mastercard is a credit card that comes with one of the highest APR rates on the market, with a variable rate of up to 35.99%.

This steep interest rate makes it essential for cardholders to pay off their balances in full each month to avoid incurring significant interest charges.

In addition to the high APR, there are several fees associated with this card that potential users should be aware of:

- Program Fee: A one-time fee of up to $95 is charged when opening the account, which can be a considerable upfront cost.

- Annual Fee: The card has an annual fee of up to $75 for the first year, billed on a monthly basis. This fee will apply even if the card is not used frequently.

- Monthly Maintenance Fee: After the first year, a monthly maintenance fee of up to $8.25 is charged, which adds up to a total of $99 annually. This ongoing fee can increase the overall cost of having the card.

- Late Payment and Returned Payment Fees: Late or returned payments can result in fees as high as $40, making it crucial to make payments on time to avoid these additional charges.

Given the combination of a high APR and various fees, the First Digital NextGen Mastercard may be better suited for those who can manage their payments carefully and avoid carrying a balance.

How to apply for the First Digital NextGen Mastercard

Applying for the First Digital NextGen Mastercard is simple and quick. Here’s how you can do it:

- Visit the Application Page: Go to the official First Digital website.

- Provide Your Information: Enter your personal details, including your name, address, income, and social security number.

- Review the Terms: Make sure to understand the fees, interest rates, and credit-building features before proceeding.

- Submit Your Application: Once you’ve completed the form, submit your application for review. Approval is typically fast.