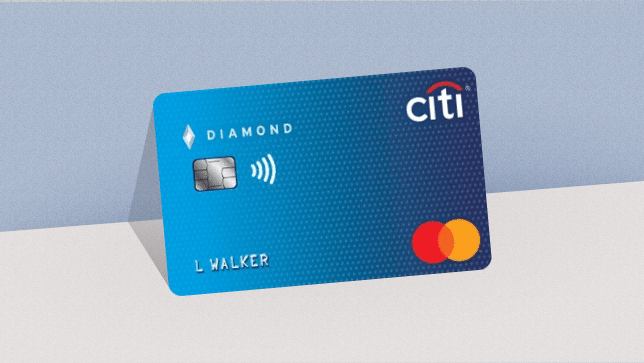

Citi Diamond Secured – How To Apply

The Citi Diamond Secured Credit Card is an excellent option for building or rebuilding credit.

Anúncios

As a secured credit card, it requires a refundable deposit, which serves as collateral for your credit limit.

It’s designed for those who may have limited or poor credit history and want a simple, reliable way to establish a positive credit profile.

Citi Diamond Secured

Low Annual Fee No Rewards ProgramHow does the Citi Diamond Secured Credit Card work?

The Citi Diamond Secured Credit Card operates as a secured card, meaning you must make a refundable security deposit to open your account. Here’s how it works:

- Security Deposit: To open the card, you’ll need to make a refundable security deposit, which will determine your credit limit.

- Earning Rewards: Unlike many secured cards, the Citi Diamond Secured Credit Card offers cashback rewards. You can earn 2% cashback on purchases at restaurants and gas stations (on up to $1,000 spent each quarter in combined categories) and 1% cashback on all other purchases.

- Building Credit: The card reports your payment history to the three major credit bureaus, helping you build or rebuild your credit score over time. By using the card responsibly and paying your bill on time, you can improve your credit standing.

- No Annual Fee: The Citi Diamond Secured Credit Card comes with no annual fee, making it a cost-effective option for those looking to rebuild credit without incurring extra charges.

- Access to Citi Benefits: Cardholders also get access to Citi’s 24/7 customer service and fraud protection, offering peace of mind and support whenever it’s needed.

Main benefits of Citi Diamond Secured Credit Card

The Citi Diamond Secured Credit Card offers several advantages for those looking to establish or improve their credit:

- Cashback Rewards: Earn 2% cashback on purchases at restaurants and gas stations (up to $1,000 per quarter) and 1% on all other purchases.

- Credit Building: The card is designed to help you build or rebuild your credit, as your payment history is reported to all three major credit bureaus (Experian, TransUnion, and Equifax).

- No Annual Fee: The Citi Diamond Secured Credit Card has no annual fee, making it a great choice for those who want to minimize costs while working on their credit.

- Refundable Security Deposit: The security deposit is refundable, and once you’ve demonstrated responsible credit behavior, you may be eligible for a credit limit increase or even the ability to convert the card to an unsecured card.

- Access to Citi’s Customer Service and Fraud Protection: Enjoy access to Citi’s world-class customer service and robust fraud protection, giving you support and peace of mind.

You will be redirected

Cons of Citi Diamond Secured Credit Card

While the Citi Diamond Secured Credit Card offers many benefits, there are a few downsides to consider:

- Security Deposit Required: Because this is a secured card, you need to make an upfront deposit, which can be a barrier for some people.

- Limited Rewards on Spending Categories: The cashback rewards are limited to certain categories, such as restaurants and gas stations, and are capped at $1,000 per quarter in combined categories.

- Foreign Transaction Fees: The card charges a 3% foreign transaction fee, which could make it less ideal for those who frequently travel abroad.

- Higher APR: The card has a relatively high APR, ranging from 24.74% to 29.74% (variable), so it’s important to pay off your balance in full each month to avoid interest charges.

APR and Fees

The Citi Diamond Secured Credit Card has a variable APR that ranges from 24.74% to 29.74%, which is relatively high compared to some unsecured cards. Cash advances also carry a high APR of 29.74%.

Late payment fees can be up to $40, so it’s important to make timely payments to avoid extra charges.

How to apply for the Citi Diamond Secured Credit Card

Applying for the Citi Diamond Secured Credit Card is a simple process. Here’s how you can apply:

- Visit the Application Page: Go to the official Citi website.

- Provide Your Information: You’ll need to provide personal details, including your name, address, income, and social security number to help determine your eligibility and security deposit amount.

- Choose Your Deposit: Choose the deposit amount you’d like to make. The minimum deposit is $200, but you can choose to deposit more, which will increase your credit limit.

- Review the Terms: Before submitting your application, make sure to review the card’s terms, including the APR, fees, and reward structure.

- Submit Your Application: Once all the information is filled out and reviewed, submit your application. If approved, you’ll receive your Citi Diamond Secured Credit Card and can start building your credit.