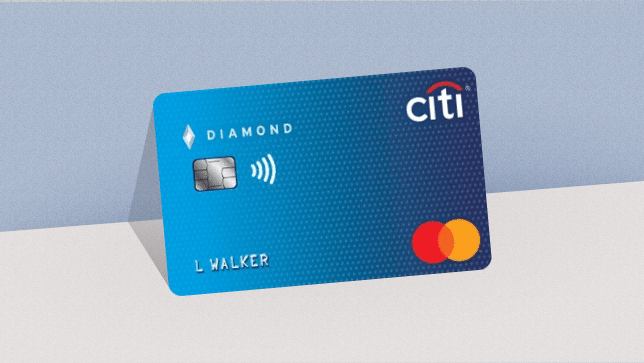

Citi Diamond Secured

The Citi Diamond Secured Credit Card helps individuals build or rebuild credit with a secure, manageable option.

Anúncios

Citi Diamond Secured

Low Annual Fee No Rewards ProgramIf you’re looking to establish a solid credit foundation, the Citi Diamond Secured Credit Card is a dependable option that provides the tools needed for financial growth.

The Best Credit Card for Rebuilding Credit

The Citi Diamond Secured Credit Card is an excellent option for anyone looking to repair their credit score or establish credit history.

With a required security deposit, this card offers the reassurance of a refundable deposit, which helps limit the risk to the lender.

Cardholders can use this card to make everyday purchases, and as they demonstrate responsible credit use, they can improve their credit profile.

This card reports to the three major credit bureaus, which is essential for building or rebuilding credit.

Pros and Cons

Pros

- Helps Build or Rebuild Credit

- Reports to All Three Major Credit Bureaus

- Refundable Security Deposit

- Low Annual Fee

Cons

- Requires a Security Deposit

- No Rewards Program

- High APR on Purchases and Cash Advances

How Do I Know if the Citi Diamond Secured Credit Card Is the Best Card for Me?

The Citi Diamond Secured Credit Card is ideal for those who are focused on building or rebuilding their credit.

If you’re new to credit or have had past financial difficulties, this card provides a manageable way to improve your credit score.

The refundable security deposit acts as a safety net, and the card’s responsible use can lead to potential credit limit increases and the possibility of upgrading to an unsecured card.

However, if you’re looking for rewards or additional perks, this card may not be the best choice, as it focuses primarily on credit-building features.

Why Do We Like This Card?

We like the Citi Diamond Secured Credit Card because it provides a secure and manageable way to build or rebuild your credit.

The refundable security deposit makes it less risky for both cardholders and lenders, and the card’s ability to report to all three major credit bureaus ensures that your credit-building efforts are tracked.

Although the card does not offer rewards or other luxury perks, its straightforward approach to credit improvement makes it an ideal choice for those looking to establish a strong financial foundation.

The low annual fee further enhances its value as a credit-building tool, making it a solid option for individuals who want to get back on track financially.

You wiil remain on the current site